-

Type:

Bug

-

Status: Closed

-

Priority:

High

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Environment:QA

-

Module:ACA - Reports

-

Reported by:Harbinger

-

Item State:Production Complete - Closed

-

Code Reviewed By:Nandkumar Karlekar

1.Login to LB.

2.Edit company 'City of Redding for Hspl'.

3.Create a single submission for type C report which will get accepted by IRS.

4.Transmit same to IRS site,

5.Wait for submission status as "Accepted".

6.Change the election effective date of the employee.

7,Rerun the 1095-C report by selecting form status as Corrected.

8.Rerun the 1094-C report without selecting any form status.

9.Finalize both report,

10.Select Transmission type as 'Correction'

11,Click on verify submission.

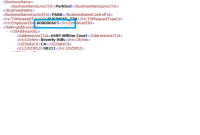

Actual: Xml file got generated with errors as

Transmission file is not valid to submit on IRS Portal. Please correct below errors..

--------------

The 'urn:us:gov:treasury:irs:common:SSN' element is invalid - The value '491' is invalid according to its datatype 'urn:us:gov:treasury:irs:common:SSNType' - The Pattern constraint failed.

--------------

The 'urn:us:gov:treasury:irs:common:SSN' element is invalid - The value '491' is invalid according to its datatype 'urn:us:gov:treasury:irs:common:SSNType' - The Pattern constraint failed.

--------------

Expected; No error should receive.

For more details, you can refer submission 'Ui submission Glam Class A one' on same company.

- relates to

-

WT-2240 ACA: UI Submission-Needed run data for user correction + irs correction new scenario

-

- Closed

-