-

Type:

Support Activity

-

Status: Resolved

-

Priority:

Critical

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Submission

-

Environment:Production

-

Reported by:Support

-

Module:ACA

-

Issue Importance:Must Have

Hi all -

I know I can change #22 and column C of part III but I do not see where I can change column b of Part III.

Please see the below changes that CVHP is requesting on their 1094C file.

Part II, Question 22 – only box B should be checked off.

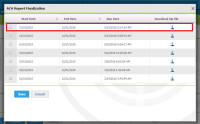

Part III, column b and column c for the following months:

January – b) 1979; c) 3162

February – b) 1988; c) 3172

March – b) 1999; c) 3195

April – b) 2011; c) 3214

May – b) 2026; c) 3235

June – b) 2036; c) 3225

July – b) 2035; c) 3246

August – b) 2045; c) 3250

September – b) 2040; c) 3280

October – b) 2021; c) 3287

November – b) 2044; c) 3286

December – b) 2058; c) 3274

Column b was calculated by counting the number of employees that worked over 130 hours per month during the 12 month measurement period. Employees who were in their limited non-assessment period were excluded.

Column c was calculated by running a full report of total number of employees on the last day of each month. No employees were excluded on this count.