-

Type:

Support Activity

-

Status: Closed

-

Priority:

Critical

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Report

-

Reported by:Support

-

Company:Gelsons Markets

-

Module:ACA - 2017

Hi Jennifer Leugers,Cathleen Harrington,

We have run 1095C report. Please refer latest run for verification.

Here are some EEs that need correction.

– The lowest cost plan for any of 1 of the 4 earnings tiers is the Kaiser Plan. In reviewing the forms, I found several employees that report different contribution amounts throughout the year. Please note that the contributions remained the same prior to May 1 so I believe these forms need to be adjusted. Here are the names:

Oscar Perez – Yes he is enrolled in Kaiser, but my note was references the lowest cost plan. From January to April, it was not showing the lowest cost plan being Kaiser ($139) – it was showing Blue Shield ($148). This is similar to all the other examples. Can you please add this to the ticket?

c. Sheridan Lewis Rardin – Changes from BS HDHP to Kaiser in May.

d. Ruben Ornelas – Changes from BS HMO to Kaiser in May.

f. Saphan Rosas - Changes from BS HMO to Kaiser in May.

g. Apolonio Ruiz – Changes from BS HMO to Kaiser in May.

h. Frank Wheeler – Changes from BS HMO to Kaiser in May.

Hi peggy fiedler,

The JAN to APRIL cost are shown wrong on 1095C PDF for below employees.

1] Oscar Perez

2] Ruben Ornelas

3] Saphan Rosas

4] Apolonio Ruiz

5] Frank Wheeler

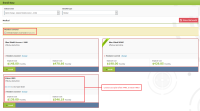

But cost on 1095C PDF for "Sheridan Lewis Rardin" employee are correct, refer enroll now screenshot attached with this email for JAN and JUN months.

Cost for 5 EE are wrong on 1095C PDF because employees are enrolled in plan using sub-rate for which EE is not eligible and EE is eligible to other sub-rate. EE became ineligible due to some employee data changes.

To resolve this issue, we can either correct the data from DB or you can add 1095C correction records from ACA 1095C Correction screen.

More time will be needed to correct the data from DB.

Below is path to correct employee data using "ACA 1095C Correction" screen.

Log in -> Select Company -> BenAdmin -> ACA -> ACA Customization -> ACA 1095C Correction tab.

On this screen select Tax Year = 2016 and provide SSN of employee for which you want to correct cost. Once changes are done on "ACA 1095C Correction" screen, please re-run 1095C report by selecting "Apply User correction = YES".

We have uploaded video for 1095C Correction on EBS FTP. Below are the ftp details. refer video "1095CManualCorrection.mp4" from zip folder for 1095C Correction.

https://ftpsecure.ebsbenefits.com/thinclient/Transfer.aspx

Path: /users/workterraaca/ACA Setup Demo

File : 2017 ACA Videos.zip

Thanks,

Sachin Hingole

Jennifer Leugers Cathleen Harrington shyam sharma Nandkumar Prabhakar Karlekar Ramya Tantry Mahendra Mungase

Hi all - the client would like to know if we have anything that is from the IRS that is showing why we moved someone from 1A to 1E the month they terminated (due to them losing eligibility in the lowest cost plan since they were not enrolled in that plan). Please see below from the client-

What happens if we (going forward) decide to structure our plans so that there is only 1 “affordable” plan and an employee who terms mid month did not elect that affordable plan as a new hire or during Open Enrollment? The logic you provide means that an unaffordable plan cost would be shown on Line 15 during the month of term even though there was an affordable option offered. In our case, the cost would still be affordable but that could change in the future. Additionally under our plan we would never allow someone to change their carriers mid month which is why we feel the Kaiser cost should continue to be shown during month of term. Do you have IRS guidance that supports EBS’ position on reporting? I searched but was unable to find anything or any examples of this situation.

Also, did the IRS approve the transition relief for non calendar year clients for 2016? Please see below from the client -

Regarding the Plan Month on the 1095-C, all of our plan documents state that we are a May 1 start. According to the 1095-C instructions it states that we are to, “enter the two-digit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which the employee is offered coverage.” If you are unable to change it to reflect 05, we would prefer that it be left blank since this is optional in 2016. Please let us know how you will proceed.

Hi Jennifer Leugers,

Comments for above queries:

1.

From IRS site:

Please refer the highlighted text.

If the affordable plan's coverage terminates before end of month,then EE does not have an offer of coverage of that plan for that month.Codes will show the next eligible plan if any,for that month.

As per the eligibility and data in the system,the functionality is correct.

In case if you want to force your codes on PDF's ,please follow below steps:

1095C form can be corrected from "ACA 1095C Corrections" page.

Path for "ACA 1095C Corrections" is : Log in -> Select Company -> BenAdmin -> ACA -> ACA Customization -> ACA 1095C Corrections

Once you do the corrections for EEs from attached PDF, re-run 1095C reports by selecting flag "Apply User Correction = YES".

We have uploaded demo video for ACA 1095C Correction on EBS FTP.

Below are FTP details for this enhancement demo, refer video "1095CManualCorrection.mp4" from below zip folder.

URL: https://ftpsecure.ebsbenefits.com/thinclient/Transfer.aspx

Path: /users/workterraaca/ACA Setup Demo

File : 2017 ACA Videos.zip

2.

Plan start month: Enter the two-digit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which the employee is offered coverage (or would be offered coverage if the employee were eligible to participate in the plan). If more than one plan year could apply (for instance, if the ALE Member changes the plan year during the year), enter the earliest applicable month. If there is no health plan under which coverage is offered to the employee, enter “00.”

In this company,medical plans start date is 05/01/2015.These plans continue in 2016 as calendar year plans.

Earliest applicable month for these plans for this year(2016) for an employee is January

For plan start month the date should actually be the plan year start date. This means all Calendar year employers will have ALL 1095s populated with 01 and all fiscal should be whenever their plan year starts.

As per the data in system this is correct.

Currently there is no provision to keep Plan start month as blank.We can handle this from backend. Please let us know your views on the same.

Hi all - the client wants to update the plan start date on all forms to show 05 and they also do not want to have the change from 1A to 1E for the month of termination. Please see below -

1. In the month of termination we want to make sure that the lowest cost plan amount is reported. I have made this change in the spreadsheet for those that I am aware - Timothy Humphreys, Ted Fujii and Claudia Ward-Oleesky.

2. Please update Plan Start Month box to 05 on all forms. If this cannot be done, please leave this box blank as it is optional in 2016.

Hi Jennifer Leugers,

1: For the month of termination changes it would be better to apply corrections because as per the data and eligibility in system,forms are correct.

Forms can be corrected using two approaches -

1) Manually correct each Employee from ACA 1095C Correction screen under ACA Customization Or

2) Simply Import Codes of those Employees.

Once the corrections are done, you can re-run the 1095C report with Apply User Correction flag as Yes

We have uploaded demo video for ACA 1095C Correction on EBS FTP.

Below are FTP details for this enhancement demo, refer video "1095CManualCorrection.mp4" and "Bulk Import Correction.mp4" from below zip folder.

URL: https://ftpsecure.ebsbenefits.com/thinclient/Transfer.aspx

Path: /users/workterraaca/ACA Setup Demo

File : 2017 ACA Videos.zip

Let us know in-case you have any queries.

2: We can overwrite plan start month to either 05 or keep it blank.

However we feel that as 05 is not correct as plan started 05/2015 and continued in 2016 as calendar year plan.So ideally system is providing correct forms with 01 as plan start month.

If Plan start month is set to 05, then the codes of Jan-April contradicts the plan start month.

Consider this scenario: An EE receiving 1E-2C for all 12 months with Plan start month as 05. Here, EE received offer from Jan-April but plan start month states that calendar month during which the plan year begins of the health plan in which the employee is offered coverage is May. So in this case 1E-2C is wrong for Jan-April.

In 2015,we had a code (2I ) to depict such cases. This year non calendar year plan relief is not applicable.

We have also set plan start month to blank and re-run the forms.

As per your request we have overwritten the plan start month.

Refer this run date for plan start month set to blank: 1/18/2017 1:07:11 AM

Refer this run date for plan start month set to 05: 1/17/2017 10:58:08 PM

I just spoke with Alyssa and she said she is comfortable with having 05 as the plan year start date and keeping the code the way it is now per #2 below. Thank you

Hi peggy fiedler,Jennifer Leugers

We have made changes in the back end to set Plan start month as '05'.

Hence forth for each run,Plan start month will be 05.

You can refer this run date for plan start month set to 05: 1/17/2017 10:58:08 PM for verification.

Received these comments from their final ACA today:

I hope you had a nice weekend! So I just finished reviewing the updated ACA forms and I have a couple of comments.

1. Michael Carter – His form changed but I did not request this change. His December reported went from 1H (Line 14) and 2D (Line 16) to 1A and 2F in January. This is incorrect. His Line 14 should be reported as 1H in January and 1A Feb- Dec. His Line 16 should be 2D in January and 2C Feb – Dec.

2. Miriam Gordon – I recently updated her status. On November 28, 2016 she transferred from a Non-Union employee to a Union employee. Therefore, I want to request an update for December. The January forms say 1H/2A, but I would like it to say 1H/2E (line 14/16 respectively).

3. Claudia Ward-Oleesky – Her forms were not updated completely per the spreadsheet I submitted. Her September shows 1E/2F but it should be 1H/2D (line 14/16 respectively) with no cost reported on line 15. Also, I noticed that in Part III line 18 there is a checkmark for March.

For these changes do I need to complete the spreadsheet again?

I was also reviewing the analytics – specifically, the MEC Indicator. Can you explain what drives the EE Count with Offer to Dependents and the FTE Count? I used a couple of pivot tables to perform some counts and I can’t tie back. They are close each month, but I thought it would be exact.

Please advise.

Thank you

Cathleen is updating 1 through 3. Thank you!

Jen,

Can you provide the answer to the analytics part - Thank you!

Hi,

In analysis report, filters can be applied to ACA 1095C Codes sheet to get the count details.

Total EE Count:Month-wise count of EE's who are employed for the whole month and Line 16 code does not contain 2E and 2A.

EE Count with Offer to Dependents: Month-wise count of EE's who are employed for the whole month and Line 16 code does not contain 2E,2A and 2D and Line 14 contains 1A,1E,1K and 1C as these codes represent offer to EE and dependents.

FTE Count: Month-wise count of EE's who are employed for the whole month and Line 16 code does not contain 2E,2A and 2D

CC: Jennifer Leugers,peggy fiedler,Cathleen Harrington,Nandkumar Prabhakar Karlekar,Smita Pawar,Sachin Hingole

My client is still asking about these numbers - can you look at her response below and let me know. Thank you!!

I started looking at the counts again. Based on what dev says on how to calculate, I tried to recalculate and here is what I have compared to the analytics page provided. Perhaps I still have something wrong? If you and your team have time, I would like to discuss further next week.

I am good with all the individual 1095-C forms though. Is this what drives all the counts on the 1094-C?

Thanks!

Total EE Count

Count of Line 16 Code Line 16 Code

Month Start Date 2C 2D 2F Grand Total Per Analytics Variance

01/01/2016 153 12 19 184 179 5

02/01/2016 159 5 19 183 184 -1

03/01/2016 164 3 19 186 182 4

04/01/2016 162 4 19 185 187 -2

05/01/2016 169 2 17 188 187 1

06/01/2016 170 4 17 191 185 6

07/01/2016 167 5 18 190 187 3

08/01/2016 169 5 18 192 189 3

09/01/2016 172 2 18 192 196 -4

10/01/2016 178 2 18 198 196 2

11/01/2016 178 1 18 197 195 2

12/01/2016 177 18 195 195 0

Grand Total 2018 45 218 2281

EE Count with Offer to Dependents

Line 14 Code (Multiple Items)

Count of Line 16 Code Line 16 Code

Month Start Date 2C 2F Grand Total Per Analytics Variance

01/01/2016 153 19 172 171 1

02/01/2016 159 19 178 178 0

03/01/2016 164 19 183 181 2

04/01/2016 162 19 181 179 2

05/01/2016 169 17 186 185 1

06/01/2016 170 17 187 184 3

07/01/2016 167 18 185 184 1

08/01/2016 169 18 187 186 1

09/01/2016 172 18 190 190 0

10/01/2016 178 18 196 195 1

11/01/2016 178 18 196 194 2

12/01/2016 177 18 195 195 0

Grand Total 2018 218 2236

FTE Count

Line 14 Code (All)

Count of Line 16 Code Line 16 Code

Month Start Date 2C 2F Grand Total Per Analytics Variance

01/01/2016 153 19 172 172 0

02/01/2016 159 19 178 179 -1

03/01/2016 164 19 183 182 1

04/01/2016 162 19 181 184 -3

05/01/2016 169 17 186 186 0

06/01/2016 170 17 187 184 3

07/01/2016 167 18 185 184 1

08/01/2016 169 18 187 186 1

09/01/2016 172 18 190 195 -5

10/01/2016 178 18 196 195 1

11/01/2016 178 18 196 194 2

12/01/2016 177 18 195 195 0

Grand Total 2018 218 2236

Hi Smita Pawar,

Can you please look into this and advise.

Thanks

CC: Nandkumar Prabhakar Karlekar,Revansiddha GaurKumar Chhajed,Sachin Hingole

Hi Jennifer Leugers,

Can you please look into this and let us know required action points for this Jira from our side.

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar,Sachin Hingole,Revansiddha Gaur,Kumar Chhajed

I think the issue here is the Analytics page does not seem to match the 1095C codes tab.

Looking at the 1.19.17 run, the Analytics tab shows the total # of EEs was 179 with 172 being FT employees.

If I look at just the January coverages on the ACA 1095C codes tab, I don't see how we get the numbers for total EE. Taking your instructions above, the total EE count looks like 184 (Analytics tab shows 179) and the FTE count looks like 172 (which shows correctly on the Analytics tab).

Please advise.

Thanks,

Jen

Hi Jennifer Leugers,

We have verified same at our end and below mentioned is our analysis for same.

Here in each case 'Employees who are employed for the whole month' is not considered.

If we apply filter for "Is Employed for whole Month" is set to Yes, then all values which are reflecting on report are correct.

Please find attached our analysis document and let us know if you need any additional information.

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar,peggy fiedler,Sachin Hingole,Kumar Chhajed,Revansiddha Gaur

I am marking this ticket as closed for now. Feel free to reopen in case any further action expected on this. Thanks.

-----------------------------------------------------

CC: Vijay Siddha, Satya, Jaideep Vinchurkar

Customization has been updated. Please run 2016 1095C for Gelson's Market

Jennifer Leugers