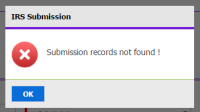

Hi all - there seem to be some issues with the XML files we sent to Davis Moore. The below is for Investments - please advise.

Kevin Walker - tagging you so you can keep up-to-date on this as I'm going to be out of the office.

From the client -

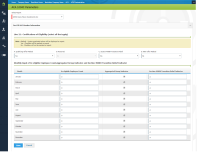

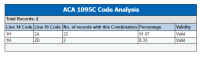

That means your 1094-C Part III column (b) was not completed for each and every month. Here’s what the errors are saying:

Since this is your authoritative transmittal, Part III must be completed.

Since line 22 box D was not checked to claim the 98% offer method, Part III column (b) must be completed to report # of FT each and every month.

The first error is saying that you didn’t enter a value in “all 12 months,” then at least one of the months must show a value greater than 0 FT employees.

The second error is saying that since there are no months with a value greater than 0, they expect to see “all 12 months” with a value greater than 0.

Our comment: you should have a value in each and every month, as you have a different # of FT each month, not the same # all 12 months.

Also, you made a comment that Part III column (a) (which asks if you offered MEC) was checked “No” for “all 12 months.” Since you offer coverage to at least 95% of FT and their dependents, that should be “yes” for “all 12 months.”

On page 2, which is Part III of the form:

Column (a) asks if you offered minimum essential coverage (MEC) to at least 95% of FT and their dependents.

This says “No” for “All 12 Months”

Did DMI offer coverage? I’d think you did and can change this to “Yes” for “All 12 Months” but if those 2 employees were not FT, then I can see why you have “No” marked

Column (b) asks # of FT each month.

This is empty all year.

Were the 2 employees not FT?

You should have a value in each month or the same value for “all 12 months.” It can be zero, despite the error code indicating at least one month should be greater than zero. I do see employers in a controlled group where the holding company has no FT employees but does have a PT employee or two, so they have to report and this column shows zero FT all year.

Column (c) asks # of total employees each month.

This is 2 for January 2016 only, then zero the rest of the year.

Does that seem right to you?

Remember owners might not be employees.

Column (d) asks if DMI was in a controlled group with all the other Davis-Moore entities.

This is marked “Yes” for “All 12 Months.”

If they only had 2 employees in January and no employees the rest of the year, then you’d only mark the box for January, not all year.

If they had the 2 employees all year, though, then this seems like it’s marked accurately.

Column (e) asks what transition relief you are claiming if you checked line 22 box C.

You do have line 22 box C checked.

The code they’ve used is a capital “A” which indicates “50-99 transition relief” and cannot possibly apply because (1) the controlled group of companies is well over 99 FTEs and (2) this year you can only claim a transition relief code for the months of your 2015 plan year that carried over into 2016 (i.e., you could only use a code for the months before your renewal, then you’d leave column (e) blank from your renewal month to Dec)

A capital “B” might make sense to use in Jan, Feb, and Mar, but you probably don’t need the relief as I have a feeling you offered to 95% of FT and their dependents. You might consider just unchecking line 22 box C and then leaving this Part III column (e) empty if you don’t need transition relief to help you escape penalties.

Support Activity

Medium

Hi all - I have selected A and C on the 1094C form for Real Estate but when I run it, only A is showing on the form. Please advise.