-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Submission

-

Reported by:Support

-

Company:Davis Moore

-

Module:ACA - 2017

- image001.jpg

- 0.3 kB

- image001.png

- 7 kB

- image002.png

- 0.6 kB

- image008.png

- 0.2 kB

- image009.png

- 0.2 kB

- image010.jpg

- 0.3 kB

- image011.png

- 0.6 kB

- IRS submission.png

- 166 kB

- screenshot-1.png

- 18 kB

Hi Jennifer Leugers,

As per IRS,

If an ALE Member checks box C, it must also indicate the type of section 4980H transition relief on Form 1094-C, Part III, column (e), Section 4980H Transition Relief Indicator, for each month to which the relief applies.

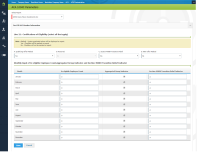

For now we have updated the Section 4980H Transition Relief Indicator on ACA 1094C Parameters with value A and re-run the report. Refer latest run.

The Box C is showing marked and Part III, column (e), Section 4980H Transition Relief Indicator has value A for all 12 months.

Note - Please confirm this from your side if this is applicable to IRS

CC Nandkumar Prabhakar Karlekar Revansiddha Gaur Smita Pawar

Hi all - there seem to be some issues with the XML files we sent to Davis Moore. The below is for Investments - please advise.

Kevin Walker - tagging you so you can keep up-to-date on this as I'm going to be out of the office.

From the client -

That means your 1094-C Part III column (b) was not completed for each and every month. Here’s what the errors are saying:

Since this is your authoritative transmittal, Part III must be completed.

Since line 22 box D was not checked to claim the 98% offer method, Part III column (b) must be completed to report # of FT each and every month.

The first error is saying that you didn’t enter a value in “all 12 months,” then at least one of the months must show a value greater than 0 FT employees.

The second error is saying that since there are no months with a value greater than 0, they expect to see “all 12 months” with a value greater than 0.

Our comment: you should have a value in each and every month, as you have a different # of FT each month, not the same # all 12 months.

Also, you made a comment that Part III column (a) (which asks if you offered MEC) was checked “No” for “all 12 months.” Since you offer coverage to at least 95% of FT and their dependents, that should be “yes” for “all 12 months.”

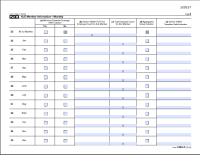

On page 2, which is Part III of the form:

Column (a) asks if you offered minimum essential coverage (MEC) to at least 95% of FT and their dependents.

This says “No” for “All 12 Months”

Did DMI offer coverage? I’d think you did and can change this to “Yes” for “All 12 Months” but if those 2 employees were not FT, then I can see why you have “No” marked

Column (b) asks # of FT each month.

This is empty all year.

Were the 2 employees not FT?

You should have a value in each month or the same value for “all 12 months.” It can be zero, despite the error code indicating at least one month should be greater than zero. I do see employers in a controlled group where the holding company has no FT employees but does have a PT employee or two, so they have to report and this column shows zero FT all year.

Column (c) asks # of total employees each month.

This is 2 for January 2016 only, then zero the rest of the year.

Does that seem right to you?

Remember owners might not be employees.

Column (d) asks if DMI was in a controlled group with all the other Davis-Moore entities.

This is marked “Yes” for “All 12 Months.”

If they only had 2 employees in January and no employees the rest of the year, then you’d only mark the box for January, not all year.

If they had the 2 employees all year, though, then this seems like it’s marked accurately.

Column (e) asks what transition relief you are claiming if you checked line 22 box C.

You do have line 22 box C checked.

The code they’ve used is a capital “A” which indicates “50-99 transition relief” and cannot possibly apply because (1) the controlled group of companies is well over 99 FTEs and (2) this year you can only claim a transition relief code for the months of your 2015 plan year that carried over into 2016 (i.e., you could only use a code for the months before your renewal, then you’d leave column (e) blank from your renewal month to Dec)

A capital “B” might make sense to use in Jan, Feb, and Mar, but you probably don’t need the relief as I have a feeling you offered to 95% of FT and their dependents. You might consider just unchecking line 22 box C and then leaving this Part III column (e) empty if you don’t need transition relief to help you escape penalties.

Hi Jennifer Leugers / Kevin Walker,

The report 1094C Davis-Moore Investments Inc had changes earlier for 2015 on ACA 1094C Paramters and the same report was being used for tax year 2016. Refer

Hence those changes got reflected for this year to.

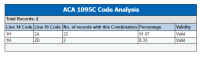

For Part III Column(b) is blank because there are only 2 employees in that report and they are not offered any coverage (you can check for 1095-C analysis report which contains 1H for all 12 months for both employees) - Refer

For Part III Column(c) as total employees count are 2 and they were only for January month hence Jan as count 2 and rest are 0.

Changes that we have done -

We have changed the customization of report 1094C Davis-Moore Investments Inc on ACA 1094C Parameters to default and

re-run the report. Now the part III looks like refer

As the Error statement says

Since line 22 box D was not checked to claim the 98% offer method, Part III column (b) must be completed to report # of FT each and every month.

-

So Box D should be checked according to IRS as FTE count is 0, but none of the employees has offer here hence please check this from your side if Box D need to marked or not. If yes you can go ahead and mark it from ACA 1094C Parameters.

Also client as stated to mark MEC indicator to All 12 months but the employees have no offer coverage hence by default it is not marked. Please let us know if this need to done as we need to change this from back-end

Please let us know if any other changes need to be done for this report we will do it for you.

Also please update the Acknowledgement status of that XML submission, if it is Accepted with error then you can run correction for that 1094C (selecting form status as corrected) then submit it to IRS and if it is Rejected then there is no need for correction.

CC Nandkumar Prabhakar Karlekar Revansiddha Gaur Smita Pawar

Thanks Kumar Chhajed.

I spoke with the client and here are his requested revisions.

Please refer the ACA Parameters screenshot you provided in your last response.

- Line 22 Box A. Qualifying Offer Method - Please change to "NO"

- Line 22 Box C. Section 4980H Transition Relief - change to "NO"

- In the section showing the months - only January should be checked in the "Aggregated Group Indicator" column

- In Section 4980H Transition Relief Indicator column all months should be left blank.

Please refer to your 3rd screenshot - Part III ALE Member Information - Monthly

- Line 23 should be empty/blank

- Line 24 - The "YES" box in column "A" should be checked. Column "B" and "C" should have the number 2. Column "D" should have and "X". Column "E" = blank

- Lines 25-35 - Column "A" should be "NO". Columns "B" and "C" should be 0. Column "D" should not be checked. Column "E" should be empty.

Let me know if you have any questions.

Thanks

Kevin

Hi Kevin Walker,

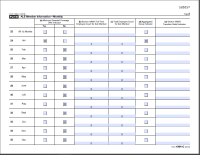

We have made the changes as per your latest comments for Report 1094C Davis-Moore Investments Inc ,please find its latest run.

Now part III looks like

and line 22 is not not marked for any boxes.

Let us know if any additional information needs

CC Jennifer Leugers Nandkumar Prabhakar Karlekar Revansiddha Gaur Smita Pawar

Davis Moore - Chevrolet

John Jonas 512961471 - Form in WT is not corrected. The Run does have the form corrected.

Dependent: Matthew Salas 512170877 is the SSN on the run, but in WT it is not corrected.

SSN for dependent Matthew Salas should be 51270877

Nader Abouali 509044555 - form in WT not correct. The Run does have the form corrected.

His Part III his last name was corrected Abouali should be in WT correctly.

Davis Moore - Automotive

Steve Klein - record was updated. When the employee downloads the form it is not showing corrected.

Part III the spouses last name was updated to: Kitselman

Same situation for Brendon Schnaithman - record was updated. When the employee downloads the form it is not showing corrected.

Before replying for above comments , we need to know that have you submitted the transmission files to IRS portal ?

Please let us know asap.

Thanks ,

Revan

Nandkumar Prabhakar Karlekar Kumar Chhajed

I ran the 3 groups for Davis Moore.

I put ran the xml file, and the Client will be running their files to the IRS.

-Cathy

From: Revansiddha Gaur (JIRA) jira@workterra.atlassian.net![]()

Sent: Friday, March 31, 2017 1:43 PM

To: Cathleen Harrington <cathleen.harrington@ebsbenefits.com>

Subject: [JIRA] (WT-8213) ACA 2017 eSubmission - Davis Moore

[Image removed by sender.]

Revansiddha Gaur<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=revansiddha.gaur> commented on [Support Activity] WT-8213<https://workterra.atlassian.net/browse/WT-8213>

Re: ACA 2017 eSubmission - Davis Moore <https://workterra.atlassian.net/browse/WT-8213>

Hi Cathleen Harrington<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=cathleen.harrington%40ebsbenefits.com>,

Before replying for above comments , we need to know that have you submitted the transmission files to IRS portal ?

Please let us know asap.

Thanks ,

Revan

Nandkumar<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=nandkumar> Kumar Chhajed<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=kumar.chhajed>

[Add Comment]<https://workterra.atlassian.net/browse/WT-8213#add-comment>

Add Comment<https://workterra.atlassian.net/browse/WT-8213#add-comment>

This message was sent by Atlassian JIRA (v1000.870.4#100039-sha1:e227a0c)

[Atlassian logo]

Davis Moore - Chevrolet

John Jonas 512961471 - Form in WT is not corrected. The Run does have the form corrected.

Dependent: Matthew Salas 512170877 is the SSN on the run, but in WT it is not corrected.

SSN for dependent Matthew Salas should be 51270877

Nader Abouali 509044555 - form in WT not correct. The Run does have the form corrected.

His Part III his last name was corrected Abouali should be in WT correctly.

- We have checked the customization, In case of Form Status is selected as 'Corrected' then it will be reflected accordingly on pdf. Form Status is not in mode of "Corrected".

- We checked the ssn 512170877 is not updated like this 51270877 & this ssn is 8 digits which is wrong.Please ensure the ssn is correct.

Davis Moore - Automotive

Steve Klein - record was updated. When the employee downloads the form it is not showing corrected.

Part III the spouses last name was updated to: Kitselman

Same situation for Brendon Schnaithman - record was updated. When the employee downloads the form it is not showing corrected.

- 1095 C customization

Actual Rule : "Davis-Moore Chevrolet, Inc. 481206480 "

Expected Rule : Davis-Moore Automotive, Inc. 48-0768111

Note : After setting the rule of expected , we found the files with updated.

We ran the file & please review the latest run & then finalize it. & If its found ok then you need to regenerate the xml files.

Thanks ,

Revan

Nandkumar Prabhakar Karlekar Kumar Chhajed

My email back to you keeps getting rejected....

From: Cathleen Harrington

Sent: Friday, March 31, 2017 2:59 PM

To: 'Revansiddha Gaur (JIRA)' <jira@workterra.atlassian.net>

Cc: Kevin Walker <kevin.walker@ebsbenefits.com>

Subject: RE: [JIRA] (WT-8213) ACA 2017 eSubmission - Davis Moore

Davis Moore Chevrolet

Jon Jonas dependent S is correct in WT. It is not correct when the EE get the form off WT.

The Dependent is: Matthew Salas 512170877

‘==============================================

For Nader Abouali 509044555

I’m sorry but I do not understand that the form is not in ‘Corrected’ status.

When I go into the ACA 1095C Corrections for this EE, I don’t see an indicator that I can select called ‘Corrected’.

‘===================================

I re-ran Automotive and reposted the xml to the Client folder.

-Cathy

From: Revansiddha Gaur (JIRA) jira@workterra.atlassian.net![]()

Sent: Friday, March 31, 2017 2:22 PM

To: Cathleen Harrington <cathleen.harrington@ebsbenefits.com>

Subject: [JIRA] (WT-8213) ACA 2017 eSubmission - Davis Moore

Revansiddha Gaur commented on WT-8213

Re: ACA 2017 eSubmission - Davis Moore

Hi Cathleen Harrington,

Davis Moore - Chevrolet

John Jonas 512961471 - Form in WT is not corrected. The Run does have the form corrected.

Dependent: Matthew Salas 512170877 is the SSN on the run, but in WT it is not corrected.

SSN for dependent Matthew Salas should be 51270877

Nader Abouali 509044555 - form in WT not correct. The Run does have the form corrected.

His Part III his last name was corrected Abouali should be in WT correctly.

• We have checked the customization, In case of Form Status is selected as 'Corrected' then it will be reflected accordingly on pdf. Form Status is not in mode of "Corrected".

• We checked the ssn 512170877 is not updated like this 51270877 & this ssn is 8 digits which is wrong.Please ensure the ssn is correct.

Davis Moore - Automotive

Steve Klein - record was updated. When the employee downloads the form it is not showing corrected.

Part III the spouses last name was updated to: Kitselman

Same situation for Brendon Schnaithman - record was updated. When the employee downloads the form it is not showing corrected.

• 1095 C customization

Actual Rule : "Davis-Moore Chevrolet, Inc. 481206480 "

Expected Rule : Davis-Moore Automotive, Inc. 48-0768111

Note : After setting the rule of expected , we found the files with updated.

We ran the file & please review the latest run & then finalize it. & If its found ok then you need to regenerate the xml files.

Thanks ,

Revan

Nandkumar Kumar Chhajed

Add Comment

As per your comments we came to know that you got acknowledgment error & trying to do correction. If so you have to upload the acknowledgement error file with receipt id. and then you select form status as 'Corrected' upon this there will be option to select the IRS Submission Customization & select the relevant customization & run the report & please ensure finalize the same.

For generation of xml files.

If IRS reported Accepted with error you need to select Correction option & generate the files.

or

If IRS reported as Rejected for the original then you need to select Replacement option & generate the files. In this case you need not to be selected anything on 1095C form status as 'Corrected'

Note :

Please find the video for xml file generation steps which are uploaded on ftp.

Ftp:https://ftpsecure.ebsbenefits.com

File Path : /users/workterraaca/ACA Setup Demo

Thanks,

Revan

Nandkumar Prabhakar Karlekar Kumar Chhajed

Davis Moore - Please see attached pic

John Jonas is the employee.

His dependent is Matthew Salas and his SSN is 512170877 and it is in WT this way.

I ran this groups form as 'CORRECTED', and downloaded them, and this record is still not correct

Kevin Walker

DM John Jonas dependent SSN CORRECTION to Dev.docx![]()

Please look into this.

Please finalize the latest run for 1095-C report '1095-C Davis-Moore Chevrolet Inc' and rerun the IRS submission.

Let me know if you any additional information.

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar,Sachin Hingole,Revansiddha Gaur,Kumar Chhajed

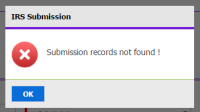

Thank you. I Finalized the 1095C for Davis Moore Chevrolet and ran the IRS Submission report as instructed, and this is the error I received.

Here is how I select this report:

Static Report -> IRS Submission -> Select Verify Submission Data

[cid:image001.png@01D2AC52.835E0B40]

Best Regards,

Cathy Harrington | WORKTERRA Project Manager

PH: 925-218-3527 | FAX: 925-460-3920 | cathleen.harrington@workterra.com

[cid:image008.png@01D2AC52.8384F430][Description: Description: Description: Description: Description: Workterra 300dpi_logo (2)]DISCLAIMER

This e-mail message (including attachments, if any) is intended for the use of the individual or entity to which it is addressed and may contain information that is privileged, proprietary, confidential and exempt from disclosure. If you are not the intended recipient, you are notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify the sender and erase this e-mail message immediately.

From: Smita Pawar (JIRA) jira@workterra.atlassian.net![]()

Sent: Monday, April 3, 2017 6:27 AM

To: Cathleen Harrington <cathleen.harrington@ebsbenefits.com>

Subject: [JIRA] (WT-8213) ACA 2017 eSubmission - Davis Moore

[Image removed by sender.]

Smita Pawar<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=smita.pawar> commented on [Support Activity] WT-8213<https://workterra.atlassian.net/browse/WT-8213>

Re: ACA 2017 eSubmission - Davis Moore <https://workterra.atlassian.net/browse/WT-8213>

Hi Cathleen Harrington<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=cathleen.harrington%40ebsbenefits.com>,

Please finalize the latest run for 1095-C report '1095-C Davis-Moore Chevrolet Inc' and rerun the IRS submission.

Let me know if you any additional information.

Thanks,

Smita

FYI Nandkumar<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=nandkumar>,Sachin Hingole<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=sachin.hingole>,Revansiddha Gaur<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=revansiddha.gaur>,Kumar Chhajed<https://workterra.atlassian.net/secure/ViewProfile.jspa?name=kumar.chhajed>

[Add Comment]<https://workterra.atlassian.net/browse/WT-8213#add-comment>

Add Comment<https://workterra.atlassian.net/browse/WT-8213#add-comment>

This message was sent by Atlassian JIRA (v1000.870.5#100039-sha1:da79de9)

[Atlassian logo]

I have finalized the Davis Moore Chevrolet and ran the IRS Submission report and it has an error.

1. The dependent Matthew Salas SSN for EE John Jonas that was incorrect is now correct - Thank you.

2. The IRS submission that I ran has an error:

Submission records not found !

Here is no need to select form status as "Correct" to reflect dependent SSN correctly on 1095-C report.

If you select form status as CORRECTED, then all employee's PDF in that run will get marked as CORRECTED.

We need to run report without any form status and you can directly submit original submission.

If you have made any corrections then in that case on IRS submission you need to update submission details such as Receipt ID, Status on IRS submission screen.

Navigational path for same is Home>>Company Home>>BenAdmin Home>>BenAdmin Company Home>>IRS Submission. PFA screen shot for additional information.

Let us know if you need any additional information.

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar,Sachin Hingole,Revansiddha Gaur,Kumar Chhajed

Hello,

Feel free to reopen in case any further action required on this. Thank you.

Hi all - I have selected A and C on the 1094C form for Real Estate but when I run it, only A is showing on the form. Please advise.