-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Labels:None

-

Support Task Type:ACA IRS Report

-

Environment:Production

-

Company:Davis-Moore Automotive, Inc.

-

Categories:ACA

-

Reported by:Client

- DMA_Corrected.jpg

- 37 kB

- DMA.JPG

- 147 kB

- clones

-

WB-418 ACA Execution 2018

-

- Closed

-

Hi Jennifer Leugers,

This group has been run.Please refer latest run dated "12/13/2017 10:06:29 PM" for verification.

Note: Measurement and Stability rules are configured in this company,but it is not considered as 2017 time-sheet is not present in this company.

Hi all - client has approved forms; please re-run final forms. Thanks!

Hi Jennifer Leugers,

This group has been run. Please download latest run for the below report(s) for verification.

| Report Name | Run details | Remark |

|---|---|---|

| 1095-C Davis-Moore Automotive Inc | 1/15/2018 3:07:34 PM | - |

Thanks,

Revan

----------------------------------------------------------------------------------------

CC-Ramya Tantry, Kumar Chhajed, Smita Pawar, Sachin Hingole, Nandkumar Prabhakar Karlekar, Gaurav Sodani

Hi Jennifer Leugers,

This is one of the EIN's that was affected by FPL percent issue.

As per mentioned in WT-12567,we have furnished PDF's of only affected employees.

There are 99 employees affected in this EIN.

Please refer run dated "1/31/2018 10:58:28 PM" for 99 affected employees.These have corrected marked in their PDF.

For full run please refer run dated "1/27/2018 2:23:57 AM".

We have reverted all manual changes that was done to furnish these 99 PDF's.

Hi all - I uploaded the IRS file and tried to run the corrections and the system is saying there are no records found. Please advise.

Need to run Chevrolet and Real Estate files as well. They are either showing the full # of forms or no record found. Expected to only see the couple of individuals that were on the error file.

Hi Smita Pawar,

Please look into this and advise.

Hi Jennifer Leugers,

There was change in Benefit type for 2 plans [Plan A PPO Plan & Plan B PPO Plan]

so those employees were not fetched in report. Due to this benefit type change,

UMR - plans were not selected on 1095- C report.

Now we have selected same and rerun 1095-C reports for corrections.

Please refer below mentioned 1095-C reports and there latest run of correction for verification.

1. 1095-C Davis-Moore Automotive Inc - Latest Run date 3/30/2018 4:21:50 AM

2. 1095-C Davis-Moore Chevrolet Inc - Latest Run date 3/30/2018 4:14:05 AM

3. 1095-C for Davis Moore Real Estate - Latest Run date 3/30/2018 4:40:48 AM

Note : For '1095-C Davis-Moore Automotive Inc' IRS report, 'Eligibility rule for additional correction'

was selected as 'Davis-Moore Automotive, Inc.-48-0768111'. We have changed same to 'Select Rule' and Rerun the report for correction.

Let us know, if you need any additional information.

Thanks!

Hi Smita - thank you for the above information. Could you tell me who made the changes to the plans? I need to make sure they are educated about making that change during this season. Thanks!

Hi Jennifer Leugers,

DMA had recently done with its OE. In Feb month, OE Development team had received its OE setup(OE-391).In this setup,changes done on stage were moved to production.On stage,this change was done by Kevin Walker.

Please find the attached screenshot of plan view history of stage environment of the changes done.

Hi all - the CHEVROLET file rejected as the IRS said it didn't have the C showing it was a correction file. When I tried to fix it, the IRS is now rejecting it due to it being a duplicate. Should I re-run it as a replacement? WT-12579 is the ticket but wanted to post on this one since this is where the correction files were run.

Hi Jennifer Leugers,

Further to the comment done in WB-429, We need the status of the transmission against Receipt ID : 1094C-18-00475335 to decide next action.

This receipt id is not updated in the system so we cannot anticipate next course of action on whether to perform replacement or correction.

We think that, when correction file was submitted for the first time,1094C-18-00475335 was received but was not updated in the system.The same file was submitted again and 1094C-18-00592838 was received which says that the submission is duplicate.This receipt id was updated in the system and its status is rejected. We cannot proceed further on receipt id 1094C-18-00592838.

Please provide us with acknowledgment file of Receipt ID : 1094C-18-00475335.

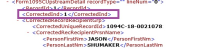

The Transmission type was marked as C and Employee Correction indicator was also marked as 1 in the submission run dated "3/31/2018 11:16:22 AM".

Please refer attached Screenshots

Hi all -

The correction file you ran for us to provide to the client is under DMA CHEVROLET dated 3.30.18 per the comments above from Smita on March 30. That file was provided to the client and it was rejected by the IRS (the rejected file is loaded under the same IRS submission). It looks like the file was rejected as it wasn't marked as Corrections.

When I tried to run a replacement or a correction file on that file, the site keeps telling me that no records exist.

Because I was working on this on the due date of the IRS, I tried to create a new run which caused the duplicate error.

Please research under DMA CHEVROLET and CHEVROLET REFILE so we can get the client a new correction file for this group in the morning.

I do not see a receipt ID OF 00475335 that you mention above.

Thanks!

Jen

Hi Jennifer Leugers,

1. We analyzed files under DMA CHEVROLET and CHEVROLET REFILE.

The correction under DMA CHEVROLET got rejected as the 1094C/1095C runs used for file generation where same as those used in original run.That's why the records were not marked as corrected.

Since both submissions under DMA CHEVROLET and CHEVROLET REFILE got rejected,we have run a correction file over original receipt id "1094C-18-00210781".

We have created a correction run under DMA CHEVROLET.As per the Acknowledgement for original transmission "1094C-18-00210781", only one employee erred out due to SSN mismatch.So there will be change only in 1095C record and that will be marked as corrected.1094C will not be marked as corrected.

We have selected 1094C run dated 02/20/2018 and 1095C run dated 3/31/2018 to create the correction file.

Please download the correction file dated "4/5/2018 11:53:16 PM" under DMA CHEVROLET.

2. Information regarding Receipt Id: 1094C-18-00475335 :

The acknowledgment file of receipt id "1094C-18-00592838" under CHEVROLET REFILE says that the transmission is duplicate of another transmission of UTID: fd4e693d-b111-40d9-a6f2-4cc0457a6a13:SYS12:BBVN6::T, Receipt Id: 1094C-18-00475335.

We verified that this UTID is used under DMA AUTO for latest transmission. So it may have happened that due to manual error, DMA Auto file got submitted for Chevrolet group which resulted in duplicate error as the Auto file was earlier submitted to IRS.

Closing this ticket

1095-C Davis-Moore Automotive Inc is ready to run. Thanks!