-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

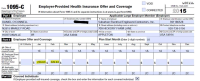

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA Data Audit

-

Reported by:White Label

-

Module:BenAdmin