-

Type:

Support Activity

-

Status: Resolved

-

Priority:

Critical

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Submission

-

Environment:Production

-

Reported by:Support

-

Module:ACA

-

Issue Importance:Must Have

Hi all -

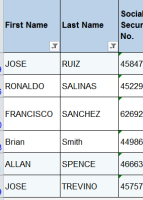

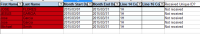

Please change #23 to Yes on the 1094C for the below Austin companies:

Austin Industrial Services, LP (EIN 760623024)

Austin Industrial Specialty Services, Inc. (EIN 270637340)

Austin Maintenance & Construction (EIN 760623027)

Once that is completed, I will be able to run their XML files out.

Thanks,

Jen