-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

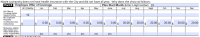

Support Task Type:ACA IRS Report

-

Reported by:Support

-

Company:City of SSF

-

Module:ACA - 2017