-

Type:

Support Activity

-

Status: Resolved

-

Priority:

High

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA Company setup

-

Environment:Production

-

Reported by:Support

-

Company:City of Irvine

-

Module:ACA

Hi All

Below is the information from the employer. Please advise.

Chimane

We reviewed the spreadsheet you sent and we are not clear on what factors are driving the spreadsheet data. From our perspective the employee’s division/class, (i.e. ASAP, City Council, Commissioner, CONF, CONFEX, Crossing Guard, EPT, ICEA, IPA, IPASGT, IPEA, IPEAEX, IPMA, MGMT, NORP, PT, RPT, Sr Citizen Council) should drive the reporting. I am also concerned that your spreadsheet is not capturing any changes that occurred during the year. We do have quite a few people who transition from EPT to full time or retire, etc.

Can you please Provide the transition data for EPT TO full time.

Employee Name

Social security no/EmpID

Employee status

From date

End date

As we understand it, a 1095C should be generated for each of the following:

-Any employee who currently is active OR who was active in any of the Full-Time or Extended Part-Time divisions at any time in 2015.

Which divisions should we consider as Full-Time or Extended Part-Time divisions.

-Any employee in a Part-Time division who enrolled in PPO medical coverage. Christina Shea and Greg Smith are the only 2 in this category.

We will furnish the 1095 c for these two Employees only for Part-Time division

-Any employee in the PT divisions who worked enough hours to be considered a full-time employee under ACA. This category includes David Cardon, Nikki Lovenduski, Stephen Torelli, Keith Hensperger as previously indicated. (All others who were in the PT division for all 12 months do not need a 1095.)

We will furnish the 1095 c for these 4 Employees only for Part-Time division

CHIMANE’s Note – These 4 people would get a 1I code in line 14 as they were eligible but didn’t get an offer

-Any Retiree who was enrolled in PPO medical coverage for any part of 2015.

Okay

-Any former employee who was active in any of the Full-Time or Extended Part-Time divisions for any part of the 2015 calendar year.

Okay

We researched the City Council, Commissioner, Senior Citizen Council and Crossing Guard divisions. There are two employees from those divisions who were covered on the PPO medical in 2015:

Christina Shea – City Council – covered under the PPO all 12 months

Greg Smith – Commissioner – covered under the PPO plan from 1/1/2015 through 7/31/2015 only.

We noticed that a 1095 was generated for Greg Smith and are concerned because it indicated that he was covered for all 12 months, even though an enrollment history report clearly indicates that his coverage ended 7/31/2015 and that effective 8/1/2015, he waived coverage. I believe Workterra lists “Waive Medical” as a plan name. Could the report be listing him as being covered for 12 months because it is just reading the fact that he has a plan name assigned for all 12 months?

We will look into this

Below are notes that Nikki has made on some of the errors we have seen:

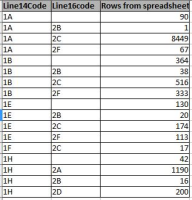

1. EPT employees (all 12 months)

- 1F code is still being used in Line 14. Example: Gregory Hogan

- We believe the correct codes would be:

a. Line 14 = 1E

b. Line 15 = $142.58

c. Line 16 = 2C (enrolled) OR 2H (did not enroll)

CHIMANE’s Note: I agree with the line 14 change and the line 16

2. Retirees (all 12 months)

- 1F code is being used in Line 14. Example: Alan Day

- We believe the correct code would be:

a. Line 14 = 1G

- All retirees had a 1095 generated but we believe only those retirees enrolled in PPO medical should receive a 1095

CHIMANE’s Note: I agree that only enrolled retirees need a 1095 and that the line 14 code should be 1G

3. PT Employees (all 12 months)

- All PT employees had a 1095 generated, but we don’t need to generate a 1095 for employees who were PT for all 12 months. Example of PT employee who received 1095 in error: Abigail Scott

- As previously identified, there were some 12 month PT employees who qualify as FT for ACA based on hours worked so they should receive a 1095:

-David Cardon

-All 12 months = 1H, 2H?

-Nikki Lovenduski

-All 12 Months = 1H, 2H

CHIMANE: these 2 people were mentioned above as well – they became eligible but the city opted not to offer coverage so they would get a 1I in the months they were eligible in line 14.

CHIMANE’s Note: I know we are working on eliminating the PT employees who never changed their status

4. Mid-Year Status Changes (ACA qualifying PT to FT)

- Example: Stephen Torelli

a. 1A, 2C code combo was used for all 12 months, but this is incorrect.

b. Stephen was a PT division employee from Jan until April, but he is one of those PT employees who worked more than 30 hours per week.

c. Correct codes for his 1095C are:

Jan-Mar = 1H, 2H

April = 1H, 2D (he was in assessment period)

May – Dec = 1E, $1.92, 2C

- Example employee: Keith Hensperger

His 1095 statement was correct in the batch from 2/9.

5. Mid-Year Status Changes (PT to EPT)

-In general, this coding structure should be used for Lines 14-16:

1H, 2B for any months prior to status change date month

1H, 2D for month of status change and month following status change date

1E, $142.58, 2C for anyone who enrolled (remaining months)

1E, $142.58, 2H for anyone who waived coverage (remaining months)

- Example: Aaron Silva

a. 2A code is being used in Line 16 from Jan through July, which indicates the employee was not employed during those months. However, Aaron was an active PT employee for those months so code 2B should be used in those months.

b. August and September are coded correctly.

c. In October code combo 1H, 2D is being used. This should be 1E, $142.58, 2H, as the offer was made in October (1E) based on the rate of pay affordability safe harbor (2H).

d. Nov – Dec code combo 1F, 2F is being used. This should be changed to 1E, $142.58, 2H as well.

6. Mid-Year Separations

- 1F, 2A code is being used in months after employee separated. Example: Jacquelynn Scott

- Code should be 1H, 2A for months following separation

Although we were not able to view specific employees in each of the scenarios below, this is the structure we expect to see on the 1095s for employees who experience the following:

COBRA

1H, 2A

Section 3 completed if enrolled in self-insured COBRA plan

Mid-Year Start Date

Full Time

-Line 14,15,16 = 1H, 2A for any months prior to hire date month

= 1H, 2D for month of hire

= 1E, $1.92, 2C for months following hire for anyone who enrolled

= 1E, $1.92, 2H ![]() for anyone who waived coverage

for anyone who waived coverage

EPT

-Line 14,15,16 = 1H, 2A for any months prior to hire date month

= 1H, 2D for month of hire and month following hire date

= 1E, $142.58, 2C for anyone who enrolled

= 1E, $142.58, 2H ![]() for anyone who waived coverage

for anyone who waived coverage

Mid-Year Status Change (PT to FT)

-Line 14,15,16 = 1H, 2B for any months prior to status change date month

= 1H, 2D for month of status change

= 1E, $1.92, 2C for months following hire for anyone who enrolled

= 1E, $1.92, 2H ![]() for anyone who waived coverage

for anyone who waived coverage

Please let us know if you have any questions.