-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Labels:None

-

Support Task Type:ACA IRS Report

-

Environment:Production

-

Company:City of Redding

-

Categories:ACA

-

Reported by:Client

- City of Redding.png

- 83 kB

- Header-006.png

- 213 kB

- Redding_Dallas.jpg

- 235 kB

- Redding_Parttime.JPG

- 56 kB

- screenshot-1.png

- 105 kB

- screenshot-2.png

- 47 kB

- screenshot-3.png

- 16 kB

- screenshot-4.png

- 50 kB

- screenshot-5.png

- 64 kB

- clones

-

WB-418 ACA Execution 2018

-

- Closed

-

We have RUN 1095-C for Redding ACTIVE report on City of Redding company.

Please refer run of Run date as of '12/7/2017 11:45:22 PM'.

Attaching QA verification check list for additional information.

Thanks

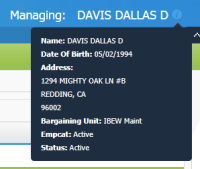

Hi all - question on some of the employees that are showing 1G (Dallas Davis for example). I can't see why from their record we are coding them as a 1G. Please look into this and let me know.

Kristi Smith FYI as I'm out of the office tomorrow.

Hi Jennifer Leugers,

Dallas Davis's employee type is Temporary.i.e he is not a full time employee.

1G was furnished because he is not a full time employee for any month of the calendar year and he is enrolled in self insured plan.

Code 1G states that :

1G: Offer of coverage for at least one month of the calendar year to an individual who was not an employee for any month of the calendar year or to an employee who was not a full-time employee for any month of the calendar year (which may include one or more months in which the individual was not an employee) and who enrolled in self-insured coverage for one or more months of the calendar year.

Code 1G applies for the entire year or not at all. Therefore, if code 1G applies, an ALE Member must enter code 1G on line 14 in the “All 12 Months” column or in each separate monthly box (for all 12 months).

If an employee is not ACA-FT during any month of the calendar year, then you would not issue them a 1095C at all, unless they enrolled in a self-funded health plan. Even if such an employee enrolls in self-funded coverage, you would enter Code 1G on Line 14 and leave Line 16 blank

Source: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

https://www.associatedbrc.com/Resource-Library/Resource-Library-Article/ArtMID/666/ArticleID/295/ACA-reporting-tip-15-Line-16-part-time-employees

CC:Nandkumar Prabhakar Karlekar,Smita Pawar,Kumar Chhajed,Kristi Smith

Ramya Tantry Hell,

Can you please verify where you are seeing that this employee for City of Redding is a temporary employee? I am showing the EE active and on benefits from hire date to present.

Thank you.

cc: Nandkumar Prabhakar Karlekar Smita Pawar Kumar Chhajed Jennifer Leugers

Hi Kristi Smith,

Employee Type can be verified from Demographics.

Please find attached screenshot of this employee's Demographics.

That is correct, See message below from the Client. He does have coverage so I believe the coverage amount and 1095C are needed. I am not as well versed in ACA as you and Jennifer Leugers so hopefully we can get this figured out for the Client.

He is a full time temporary employee subject to ACA insurance coverage. He and the others on the spreadsheet are not considered seasonal or variable hour so we are required to offer them group health benefits like all other employees. These fulltime temporary employees were correctly reported for 2016 after you adjusted them to reflect coverage from there hire date.

The employees that were correct on the spreadsheet were employees that became permanent during the year but all of them should have the same 1095C reporting I believe.

Hi Kristi Smith,

As per implementation, system considers employee type other than full time or null(i.e employee type not set on demographics) as part time.So for the system this employee is part time and as per the data in the system, codes furnished are correct.

There are two ways to offer them benefits as other employees

1. Change the employee type in demographics effective 01/01/2017 to full time.

2. Import/force the codes that you want for this employee.Imported Codes will get furnished on 1095C.

In-case you want to force the codes),you can

1) Manually correct each Employee from ACA 1095C Correction screen under ACA Customization Or

2) Import Codes of those Employees using bulk import.

Once the corrections are done, 1095C report need to be re-run with Apply User Correction flag as Yes.

*Note *: Development Team is not allowed to make any changes in the system.

CC: Nandkumar Prabhakar Karlekar,Smita Pawar,Jennifer Leugers

Jennifer Leugers Hi Jen, I am not sure what process we should follow per Ramya's comments above. It sounds like Shawn wants the code changed but you are the expert so I will leave that up to you.

Let me know what further I can do to assist. I am OOO 12/22-1/1.

Thank you.

Hi all - below are the changes that the client would like to see. Please advise if you are able to review/update or if we need to fill out the corrections template. Thanks!

Full-time, permanent appointments:

Kenneth Bailey – Part III is not filled out at all, full time temp hire date 2/7/17, full time hire date 03/26/17

Anthony Green – Was offered coverage from date of hire, 5/4/17, NOT all 12 months

Joshua Newnam – Part II – was hired as a full time temp and offered coverage beginning July (still employed) Lines 14 and 15 blank.

Thomas McCollum – Part II and III, employed as a full time temp beginning in May – Both Part II and III incorrect

Michael Foss – Hire date 5/30/17 as full time temp, NO 1095

Khae Saelee – Part III is not filled out, hire date 10/2/17

Richard Barrera – Part II, was employed as a full time temp and offered coverage beginning 9/5/17, full time 11/19/17-Lines 14 & 15 incorrect

Bernard Shaw – Part II, was employed as a full time temp and offered coverage beginning 6/5/17, full time 11/19/17 Lines 14,15 16 incorrect

These others without 1095s have just been hired in December: John Daines, John McNurlin, Danielle Nance, Lynn Herreid- All should have a 1095

Full time terminations:

Mark Olson –

Sage Baker –

Jason McCormick – Should have no coverage beginning April, separated 3/5/17

Elizabeth Handley – March coverage amt should be $155

Dennis Meza – June coverage amt should be $155

Robert Paoletti – Not offered coverage all 12 months, separated in June

Margie Walker – NO 1095

Steve Capfer – Had coverage in August, no amt listed

Kevin Bradford – Had coverage in August, no amt listed

Christopher Sparber – August amt should be $155

Michael Bachmeyer – august amt should be $155

Lester Stout – Not offered coverage all 12 months, separated in August AND August amt should be $155

Randy Amaral – September amt should be $155

Robert Frederick – Code 2B in October, should be 2A

Brenna Bowers – Should the code be 2H? She was offered coverage but it was declined. (Not sure if this was wrong or not)

Hi Jennifer Leugers,

Please find my comments inline.

Since we cannot do any updates to the system,it would be better if correction is done.

Full-time, permanent appointments:

Kenneth Bailey – Part III is not filled out at all, full time temp hire date 2/7/17, full time hire date 03/26/17

– Not enrolled in any ACA Plan.So part III is not marked.

Anthony Green – Was offered coverage from date of hire, 5/4/17, NOT all 12 months

– EE was hired on 07/11/2016.As per implementation,his latest employee type is considered for the whole range.So he is full time for whole range and got codes accordingly.

Joshua Newnam – Part II – was hired as a full time temp and offered coverage beginning July (still employed) Lines 14 and 15 blank.

--As per implementation, system considers employee type other than full time or null(i.e employee type not set on demographics) as part time.So for the system this employee is part time and as per the data in the system, codes furnished are correct.1G was furnished because he is not a full time employee for any month of the calendar year and he is enrolled in self insured plan.

Thomas McCollum – Part II and III, employed as a full time temp beginning in May – Both Part II and III incorrect

--EE changed from Part time to full time effective 08/27/2017 even if he was hired in May.So correct codes showed up after August.Please correct this employee if required.

Michael Foss – Hire date 5/30/17 as full time temp, NO 1095

--This employee does not come up as eligible in 1095C report.

Khae Saelee – Part III is not filled out, hire date 10/2/17

– Not enrolled in any ACA Plan.So part III is not marked.

Richard Barrera – Part II, was employed as a full time temp and offered coverage beginning 9/5/17, full time 11/19/17-Lines 14 & 15 incorrect

--As per implementation, system considers employee type other than full time or null(i.e employee type not set on demographics) as part time.So for the system this employee is part time and as per the data in the system, codes furnished are correct.1G was furnished because he is not a full time employee for any month of the calendar year and he is enrolled in self insured plan.

Bernard Shaw – Part II, was employed as a full time temp and offered coverage beginning 6/5/17, full time 11/19/17 Lines 14,15 16 incorrect

--As per implementation, system considers employee type other than full time or null(i.e employee type not set on demographics) as part time.So for the system this employee is part time and as per the data in the system, codes furnished are correct.1G was furnished because he is not a full time employee for any month of the calendar year and he is enrolled in self insured plan.

These others without 1095s have just been hired in December: John Daines, John McNurlin, Danielle Nance, Lynn Herreid- All should have a 1095 – All have 1095C in latest run

Full time terminations:

Mark Olson, Sage Baker – No data given

Jason McCormick – Should have no coverage beginning April, separated 3/5/17

– Employee is having Part III marked till March.

Elizabeth Handley – March coverage amt should be $155

– Some plans have EE lowest cost set in ACA Customization.This is overwriting the costs.Please review ACA Customization.

Dennis Meza – June coverage amt should be $155

– Some plans have EE lowest cost set in ACA Customization.This is overwriting the costs.Please review ACA Customization.

Robert Paoletti – Not offered coverage all 12 months, separated in June

--Employee is having Part III marked till June.

Margie Walker – NO 1095

--Her report is generated by the name Margie Briggs.She has changed her name.

Steve Capfer,Kevin Bradford – Had coverage in August, no amt listed

--EE is eligible for 2 plans in the month of August and minimum of those got listed.As line 14 has code 1A, no amount is listed.

Christopher Sparber – August amt should be $155

– Some plans have EE lowest cost set in ACA Customization.This is overwriting the costs.Please review ACA Customization.

Michael Bachmeyer – august amt should be $155

– Some plans have EE lowest cost set in ACA Customization.This is overwriting the costs.Please review ACA Customization.

Lester Stout – Not offered coverage all 12 months, separated in August AND August amt should be $155

– He is a cobra employee and cobra continuation coverage is specified as :

Line 14 – Always use Code 1H (no offer of coverage).

Line 15 – Leave Line 15 blank.

Line 16 – Use Code 2A (employee not employed during the month).

Part III – Individual Monthly Coverage Information. Employers with self-insured plans will complete this section for former employees and dependents who enroll in COBRA and will continue to report for as long as COBRA coverage is in force.

Randy Amaral – September amt should be $155

– Some plans have EE lowest cost set in ACA Customization.This is overwriting the costs.Please review ACA Customization.

Robert Frederick – Code 2B in October, should be 2A

– Employee was terminated in October and as per priorty 2B code came up.He has offer for that month hence 1A code come up for that month.1A-2A combination would be invalid as 1A says that he had oualifying offer and 2A says that he was not employed for that month.

Brenna Bowers – Should the code be 2H? She was offered coverage but it was declined. (Not sure if this was wrong or not)

– Employee was enrolled in ACA Plan for Jan month only.She had offer of coverage which is affordable to her as per Rate of Pay safe harbor.Safe Harbor is selected on ACA Customization.

CC:Smita Pawar,Nandkumar Prabhakar Karlekar,Revansiddha Gaur,Kumar Chhajed

HI all - I made updates to their forms through the UI corrections tab; please re-run and ensure the below individuals are included in the run -

Jim Yost

Robert Waterman II

Corinne Matson

Michael Foss

Palatuwa Rupasinghe

Mark Stratton

Hi Jennifer Leugers,

I ran the report at 1/15/2018 12:33:19 PM, & checked below Individuals are included in the run but the individuals haven't found in the run except one the employee Robert Waterman II.

Jim Yost,Corinne Matson,Michael Foss,Palatuwa Rupasinghe,Mark Stratton

You need to add those individuals ssns in the eligibility rule criteria by clicking on edit rule. Please find the screenshot.

Once criteria is updated, please let us know to run the report.

Thanks,

Revan

------------------------------------------------------------------------------------

CC-Ramya Tantry,Kumar Chhajed, Smita Pawar, Sachin Hingole, Nandkumar Prabhakar Karlekar, Gaurav Sodani

How should I add them? By saying Or SSN equal to? I've included there socials herein incase that is easier.

Yes that would be great - ty!

Hi Jennifer Leugers,

This group has been run by applying user correction. Please download latest run for the below report(s) for verification.

| Report Name | Run details | Remark |

|---|---|---|

| 1095C for Redding ACTIVE | 1/15/2018 4:52:24 PM | View Analysis Report against the run for Discrepancy report-Need to correct the discrepancy to generate the xml files successfully for IRS Submission. |

Confirmed that below individuals are included in the run.

- Jim Yost

- Robert Waterman II

- Corinne Matson

- Michael Foss

- Palatuwa Rupasinghe

- Mark Stratton

Observation:

A.Qualifying Offer Method-No

Thanks,

Revan

-----------------------------------------------------------------------------------------

CC-Ramya Tantry, Kumar Chhajed, Smita Pawar, Sachin Hingole, Nandkumar Prabhakar Karlekar, Gaurav Sodani

Hi all - we made a couple more edits and that should be all of them. Please re-run their final forms. Thanks!

Hi Jennifer Leugers,

We have rerun the '1095C for Redding ACTIVE' report.

Please refer latest run '1/25/2018 12:44:29 AM' to download the report.

Thanks,

Smita

Hello

I do not know if anyone on the Development team can help me in Jen's absence however I received the below message from City of Redding regarding their XML filing with the IRS. The print screen shows the error they are receiving. Thank you.

From: Avery, Shawn <savery@ci.redding.ca.us>

Sent: Wednesday, March 14, 2018 4:05 PM

To: Jennifer Leugers <Jennifer.Leugers@workterra.com>; Kristi Smith <Kristi.Smith@workterra.com>

Cc: Robinett, Gregory <grobinett@ci.redding.ca.us>

Subject: FW: City of Redding ACA - XML File Error

Hi Jennifer and Kristi – We are getting the below error code from the IRS on our XML file you provided. The IRS believes it may be in regards to the new login criteria. Can you please send us a replacement file referencing “Receipt ID”. If you have any questions please contact our Senior Accountant, Greg Robinett at 530-225-4088.

Shawn Avery

Personnel Manager

City of Redding

Phone: (530) 225-4524

Email: savery@cityofredding.org

We’re listening…

Confidentiality Notice: This e-mail message, including any attachments, is for the sole use of the intended recipient(s) and may contain confidential and privileged information. Any unauthorized review, use, disclosure, or distribution is prohibited. If you are not the intended recipient, please contact the sender by reply e-mail and destroy all copies of the original message.

cc: Ramya Tantry Kumar Chhajed Sachin Hingole Nandkumar Prabhakar Karlekar

Hi Kristi Smith,

We have encountered such error 1st time.

From the description given below, our understanding and suggestions are as follows.

As per IRS guide lines, please verify that transmitter Control Code (TCC – included in the ACA Business Correlation ID) is valid for tax 2017, in the “Active” status, and authorized to transmit the Information Returns included in the transmission. (Note:

If the transmission is rejected with Header-005 or Header-006 (SysError 1 or 2) wait 24 hours, then

re transmit.) and if its validated then please wait for 24 hrs and re transmit the submission.(There is no need to need to re-run the submission. Please re transmit the original submission on IRS portal. )

Similarly verify that the TCC is authorized (Roles - Issuer or Transmitter) to transmit the forms in the transmission

and that the forms are in Production ‘P’ status. [You can verify same at IRS PORTAL].

If same problem persist again, please contact IRS help desk.

PFA screen shot for additional information.

Please refer link "https://www.irs.gov/pub/irs-pdf/p5165.pdf" and search for 'Header-006' if required.

Thanks!

This is wonderful information. Thank you so much!

Hi Kristi Smith,

City of Redding is using their own TCC.

You will get TCC which is used by City of Redding on below mentioned path.

Home >> Company Home >> ACA >> Settings >> ACA Parameters

So it needs to be verified that TCC which 'City of Redding' is using is in Active status or not for Tax year 2017 and authorized to transmit the Information Returns included in the transmission.

Similarly if required verify that TCC which is used by 'City of Redding' is authorized (Roles - Issuer or Transmitter) to transmit the forms in the transmission and that the forms are in Production ‘P’ status. [You can verify same at IRS PORTAL].

Let us know, if any information is unclear, we can assist accordingly.

Thanks!

Hi all - the rejection file that I uploaded to WORKTERRA is showing only one error but when you look at the actual ACK file, it looks like there are more than one unique record # that they are showing as having an error. Could you please look into this?

Hi Jennifer Leugers,

There is no any acknowledgement uploaded file present in the company 'City of Redding' on below mentioned path.

Path: Home >> Company Home >> ACA >> IRS submission >> IRS REDDING SUBMISSION

PFA screen shot for additional information.

Let us know the status of submission as it is not updated in the system.

Could you please elabrote on 'It looks like there are more than one unique record # that they are showing as having an error.'.

Thanks!

Well that is confusing as I downloaded the file yesterday. It is attached. Why would it not have saved when I submitted? The standard convention was too short so I added AA to the end. I did reload the file and it showing more errors now (as to what we expected).

Hi Jennifer Leugers,

As the acknowledgement file was not uploaded in Workterra, other records were not displayed.

When we have analysed the Error analysis report below mentioned are our observations.

In first tab ACA IRS Error Analysis Report, we observed Error for business rules '1095C-010-01' & 'Shared-008'.

Xml error code for same is AIRTN500.

These TIN validation errors needs to get corrected not only for employees but also for his dependents.

These issues are due to data mismatch of Last name, First name, Middle initials or SSN in IRS database.

As these errors are present in submission you are receiving submission status as 'Accepted with Error'.

Note: Please send Tab-2 'ACA 1095C Discrepancy Report' if errors are present in report and Tab -4 'ACA TIN Validation Error Report' to client.

You can also refer to WB-462 'ACA_2018_Austin - Bridge and Road' for additional information.

There we have explained similar errors.

Let us know, if you need any additional information.

Thanks!

All - it is not really relevant at this point but I DID submit the ACK file back on the day in which I questioned the amount of errors. I uploaded the file as PROOF that the ACK file was uploaded. So not sure what happened ...

Hi Jennifer Leugers,

As acknowledgement file was not imported into the system, so other records are not displayed with reference to screen shot attached on 21 March 2018.

Could you please let us know, steps to Repro this issue so that we can analyse it further.

Thanks!

Closing this ticket

Report 1095C for Redding ACTIVE ready to run. Thanks!