-

Type:

Bug

-

Status: Closed

-

Priority:

High

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Environment:Production

-

Module:ACA - 2017

-

Reported by:Harbinger

-

Item State:Production Complete - Closed

-

Issue Importance:Can Wait

This need to consider for 2017 IRS Reporting.

Production Company - County of Del Norte

Rate Name - EIAHealth PPO 80/60 ACTIVE

Employee Name - Stormy L Borelli

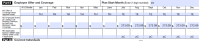

Rates shown on Enroll Now and PDF are different (Please Note Enroll Now rates are correct), refer JIRA WT-2965

Prerequisite

1 Rate is created and also sub rate is created

2 Sub rate has setting Flat Rate + % of Monthly Rate for Calculate Contributions for this Plan by

3 refer customization done for sub rate

4 employee is created and eligible to plan which is mapped with rate created in above prerequisite and is enrolled in plan (Make sure employee only monthly cost should be greater than 9.5% of FPL (for 2015 FPL amount was about $11777))

steps

1] create 1095C report

2] download 1095C and observe the employee Line 15 cost