-

Type:

Bug

-

Status: Production Complete

-

Priority:

Critical

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: None

-

Labels:None

-

Environment:Production

-

Module:BenAdmin - Enrollment

-

Reported by:Client

-

Company:Softchoice

-

Item State:Production Complete

-

Sprint:WT Sprint 31-Bugs

-

Code Reviewed By:Jyoti Mayne

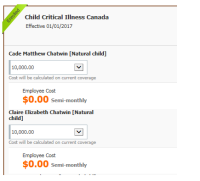

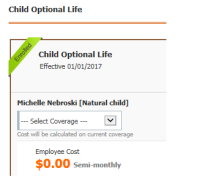

ISSUE 1: Child optional life in both Softchoice and Softchoice OE Test are showing no election for open enrollment, yet they have elections under the current plan.

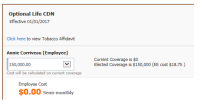

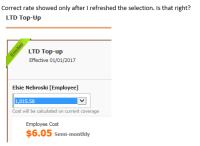

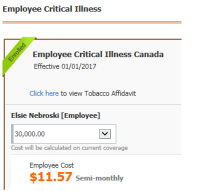

ISSUE 2: Employee optional life in Softchoice OE test (not sure about other) is not recalced despite recalcing yesterday: From client- "when I originally landed on the Optional Life enrollment for Francis Li it was showing the wrong rate ($48 I think), then I ‘refreshed’ it by selecting the tobacco affidavit and it corrected to the proper rate."

Please correct ASAP. Also, since we've now recalced several times, how can we be assured that this will stick through the enrollment?

- relates to

-

WT-9980 WT -> Problem with Maximum Contingent Coverage Total in case of salary decrease

-

- Open

-