-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Report

-

Reported by:Support

-

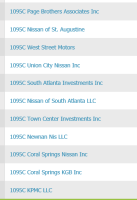

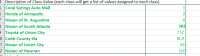

Company:KPAG

-

Module:ACA - 2017

- relates to

-

WT-7247 Ken Page 2016 1095 Draft Form Corrections

-

- Closed

-