-

Type:

Support Activity

-

Status: Closed

-

Priority:

Medium

-

Resolution: Done

-

Affects Version/s: None

-

Fix Version/s: None

-

Component/s: ACA

-

Labels:None

-

Support Task Type:ACA IRS Report

-

Reported by:Support

-

Company:KPAG

-

Module:ACA - 2017

- relates to

-

WT-7247 Ken Page 2016 1095 Draft Form Corrections

-

- Closed

-

Hi Jennifer Leugers,

KPAG forms will be ready for verification tomorrow(11/18/2016).

Hi Jennifer Leugers,

We have re-run KPAG forms. Please refer latest run for verification.

Customization updated to not select a value for the conditional offer; please re-run all reports. Thanks!

Additional issues / questions with their initial runs -

Employees have line 16 missing for one month for some reason

Terminated employees have a different amount on line 15 on their last month than the other months

I've asked lisa davison to provide examples as soon as she gets them from the client.

Hello All,

Below I have listed EIN's and addressed needed.

EIN Name Address

59-2317215 Page Brothers Associates, inc. 9400 W. Atlantic Blvd, Coral Springs, FL 33071

59-2317213 Coral Springs Nissan, Inc. 9350 W. Atlantic Blvd, Coral Springs, FL 33071

59-2413280 Coral Springs KGB, Inc. 9300 or 9330 W. Atlantic Blvd, Coral Springs, FL 33071 (this is 2 dealerships and have 2 different addresses, but same EIN

90-0889734 KPMC, LLC 9400 W. Atlantic Blvd, Coral Springs, FL 33071

26-4055944 Nissan Of St Augustine, Inc 2755 US1 South,. St Augustine, FL 32086

52-2189209 West Street Motors, LLC 1736 West Street, Annapolis, MD 21401

65-0511721 Union City Nissan, Inc 4080 Jonesboro Road, Union City, GA 30291

27-3328876 South Atlanta Investments, Inc 4115 Jonesboro Road, Union City, GA 30291

16-1725347 Nissanof South Atlanta, LLC 6889 Jonesboro Road, Morrow, GA 30260

20-8110812 Town Center Investments, Inc 1221 Auto Park Drive NW, Kennesaw, GA 30144

46-1852730 Newnan Nis, LLC 783 Bullsbroro Drive, Newnan, GA 30265

In addition, I have attached the names of sample employee's $$ amount differences in last month and missing a code or two.

Brittany Daniels - Terminated

Adrien Hemans - Active

Andrew Londin - Terminated

Dennis Yu - Active

Denniston McKitty - Terminated

Anthiny Martorano -Cobra

AAron Theruaylt - Active

David Garcia - Inactive

Louis Diana - Terminated

Please verify the EIN and address and re run reports for 2016.

hi Ramya Tantry

We have verified EIN and address on company and observed that bewlo EIN data does not match with given data in same ticket.So we have updated data as per given.

Also we have run 1095C on Production and observed that all code combination are valid.

Below EIN correction done on Production KPAG company

461852730 Newnan Nis, LLC 783 Bullsbroro Drive, Newnan, GA 30265 | Lena Polston

900889734 KPMC, LLC 9400 W. Atlantic Blvd, Coral Springs, FL 33071 | Cindy Morrow

650511721 Union City Nissan, Inc 4080 Jonesboro Road, Union City, GA 30291 | Lena Polston

273328876 South Atlanta Investments, Inc 4115 Jonesboro Road, Union City, GA 30291

161725347 Nissan of South Atlanta, LLC 6889 Jonesboro Road, Morrow, GA 30260 | Lena Polston

592317215 Page Brothers Associates, inc. 9400 W. Atlantic Blvd, Coral Springs, FL 33071 |Cindy Morrow

Thanks

Hi Jennifer Leugers,lisa davison,

We observed that safe harbor is set to rate of pay for all ACA plans.So to calculate rate of pay,rate type and current rate is considered. If rate type is not present then we use gross annual salary for safe harbor cost calculation.

Safe harbor codes will come only if employee cost is less than safe harbor cost.

Below employees have missing line 16 code because ,these employees gross annual salary have been changed in month of Feb to 0.

Brittany Daniels - Terminated

Adrien Hemans - Active

Dennis Yu - Active

Andrew London - Terminated : EE was terminated in the month of March.So eligibility of minimum cost plan "United Healthcare Choice Plus HSA" ended on the day of termination.He was enrolled in "United Healthcare Choice Plus" plan till 3/31/2016.So for the March month,"United Healthcare Choice Plus" plan came up as minimum cost plan.So there are differences in amount in the last month.

Same scenario of Andrew London is for Anthony Martorano -Cobra , Louis Diana - Terminated

Below employees did not get line 16 code because, as per their gross annual salary, safe harbor cost is coming up less than employee cost.So no safe harbor codes are displayed.

Denniston McKitty - Terminated

Aaron THERIAULT - Active

David Garcia - Inactive

Above mentioned employees codes are correct as per the data in system. If codes are to be corrected for these employees please correct employees salary data or only codes can be corrected from ACA 1095C Correction tab in ACA Customization. Reports need to be re-run after code correction with apply user correction as Yes.

We have re-run reports after the change of conditional offer.Please refer latest run for Verification. Also please refer to Mahendra's comment above for EIN changes done.

Closing the ticket as final forms are approved.

Refer WT-7247 for more details

Hello All,

It appears we failed to generate a 1095 form for EE: Javel Wright. Dev can you determine why the record wasn't included on the 1095 reporting? Also, can we check to see if anyone else was affected.

Hi Smita Pawar,

Can you please look into the query and advise.

CC: Nandkumar Prabhakar Karlekar,Kumar Chhajed,Revansiddha Gaur,Sachin Hingole

Hi lisa davison

'Javel Wright' employee's EIN was blank in database.

Currently we have updated dummy EIN for employess which were having blank EIN.

We have created a new eligibility rule 'New Rule 17' and new 1095-C report as "1095-C New Report".

Please refer latest run to download report.

Note: Let us know required EIN for those employees which needs to be updated for those employees.

Currently we have processed these employee under EIN 592317215

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar, Revansiddha Gaur, Sachin Hingole,Kumar Chhajed

Dev,

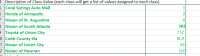

The assigned EIN is based on employee class 1 (dealership). I have listed the EIN's number per location below

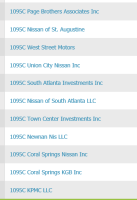

59-2317215 Page Brothers Associates, inc.

59-2317213 Coral Springs Nissan, Inc.

59-2413280 Coral Springs KGB, Inc.

90-0889734 KPMC, LLC

26-4055944 Nissan Of St Augustine, Inc

52-2189209 West Street Motors, LLC

65-0511721 Union City Nissan, Inc

27-3328876 South Atlanta Investments, Inc

16-1725347 Nissanof South Atlanta, LLC

20-8110812 Town Center Investments, Inc

46-1852730 Newnan Nis, LLC

WT LOCATION CLASS

also, I RAN A CENSUS report and noticed some employees with a EIN# 12345678- Can you also make sure these employees are assigned under the correct EIN#'s.

thanks

Hi lisa davison,

PFA file of employees without EIN.

Please update the EIN in attached sheet.

It will be very helpful for us to complete task correctly.

In this file, 3 employee's are without class 1. Please update Class 1 data for these employees.

Note: Sending password in separate mail.

Thanks,

Smita

FYI Nandkumar Prabhakar Karlekar, Sachin Hingole, Kumar Chhajed,Revansiddha Gaur

Hello,

Please review the spreadsheet with the updated EIN's. The first 3 employees in EBS / Workterra don't belong to Ken Page or in WT please remove.

Hi lisa davison,

We have updated the EIN of the employees as per the spreadsheet you have provided.

FYI we are not running the reports as we saw that you have submitted the XML Submission for those reports and it can cause problem for IRS submission if we change the customization now.

If you want those employees under the run then you can re-run the reports as we have updated their EIN from back-end.

Let us know if you have any queries.

CC Nandkumar Prabhakar Karlekar Revansiddha Gaur Smita Pawar

Kumar,

the client has reported back for the following locations line 16 codes are missing. in quickly reviewing the examples provided, it appears line 16 is blank following the limited assessment period.

Can you check the below locations and determine why line 16 is blank:

Town Center Investments (dba Cobb County Kia)

Newnan Nissan

Nissan of Union City

South Atlanta Investments (dba Toyota of Union City)

Nissan of South Atlanta

Example Employees:

David Jech

Chance Drake

Bonnie Mullinax

Gabriell

Malik Grant

James lOVINS

tHANKS

Hi Smita Pawar

Please look into this.

CC Nandkumar Prabhakar Karlekar Revansiddha Gaur Ramya Tantry Sachin Hingole

Hi lisa davison,

I have checked these employes and their salary data is not available into the Workterra System.

Thanks,

Nandkumar

for informational purposes, why does salary matter?

Hi lisa davison,

line 16 will get code 2C if employee is enrolled in ACA plan else system will write safe harbor codes.

To calculate safe harbor codes, we need to calculate 9.66% salary and offered cost.

If offered cost is less then 9.66% salary then system will write the safe harbor code else it will be blank.

1095 c PDF has the detail explanation for the same for more information you can refer the 1095 c PDF.

Hey Nandkumar,

Sorry for the delay the client just responded. Per the client request for those with blank line 16, can we code them from the back end using 2H for those that did not elect coverage, 2C for those you did elect coverage?

If required take the help of Kumar Chhajed

Hi lisa davison,

This task can be done from UI also.

Below mentioned are the steps to complete this.

1.Edit company & Navigate to Home >> Company Home >> BenAdmin Home >> BenAdmin Company Home >> ACA >> IRS report

2.Edit required 1095-C report & Click on Show run to Download data analysis report.

3.Filter those employees with line 16 code as blank

4.Navigate to Home >> Company Home >> BenAdmin Home >> BenAdmin Company Home >> ACA >> ACA Customization

5.Click on ACA 1095C corrections tab.

6.Click on Download Specifications. Select '1095C Import - PART II' sheet.

7.Prepare import file with correction codes using specification for those employee having Line 16 code as blank to import data

8.Import data by navigating to Home >> Company Home >> Manual Import/Export by using template 'ACA Correction 1095 C Part II SSN'

9.Rerun the 1095-C report by setting User Correction to YES.

With these steps corrections will get reflected on 1095-C report. Let us know if you need any additional information.

CC: Jennifer Leugers,Nandkumar Prabhakar Karlekar,Rakesh Roy,Sachin Hingole,Yogesh Chaudhari,Revansiddha Gaur

Hi lisa davison,

I am marking this ticket as closed for now. Feel free to reopen in case any further action expected on this. Thanks.

-----------------------------------------------------

CC: Vijay Siddha, Satya, Jaideep Vinchurkar

Hi Jennifer Leugers

Please verify ACA Customization on this company and please make changes on this screen if necessary,so that the report can be re-run with latest customization.

CC: Nandkumar Prabhakar Karlekar,Sachin Hingole